How a Revolutionary App Is Bridging the Financial Divide and Empowering Billions

In the heart of rural Guinea, a mother tucks her family’s hard-earned savings under a mattress every night—not out of choice, but necessity. Across the ocean in the bustling city of Miami, a corner store owner closes her shop daily, unable to serve customers who need basic banking services. In Dakar, Senegal, a young woman juggles long, grueling trips just to send her daughter to school.

Their stories are unique, yet they share a single thread—a sharp divide caused by financial exclusion. Three billion people across the globe—the unbanked and underbanked—remain locked out of the global economy. For billions, the simple act of sending money or paying for a service is riddled with inefficiencies, high fees, or exclusion entirely due to a lack of access to financial institutions.

But these stories don’t need to end this way. Enter PayCruiser—a revolutionary neobanking platform on a mission to transform financial landscapes as we know them. Founded by visionary Ousmane Conde, whose own life was shaped by his mother’s struggles with financial exclusion, PayCruiser isn’t just another fintech app. It’s a bridge to opportunity, a lifeline for billions, and, above all, a movement designed to connect the unconnected.

Breaking Barriers, Building Possibilities

Imagine a world where every corner store functions not only as a place to buy snacks and essentials but also as a financial hub—a mini bank where entrepreneurs, farmers, and everyday families can send and receive payments, pay bills, and access digital services once out of reach. This isn’t a vision decade away; it’s happening now, with PayCruiser.

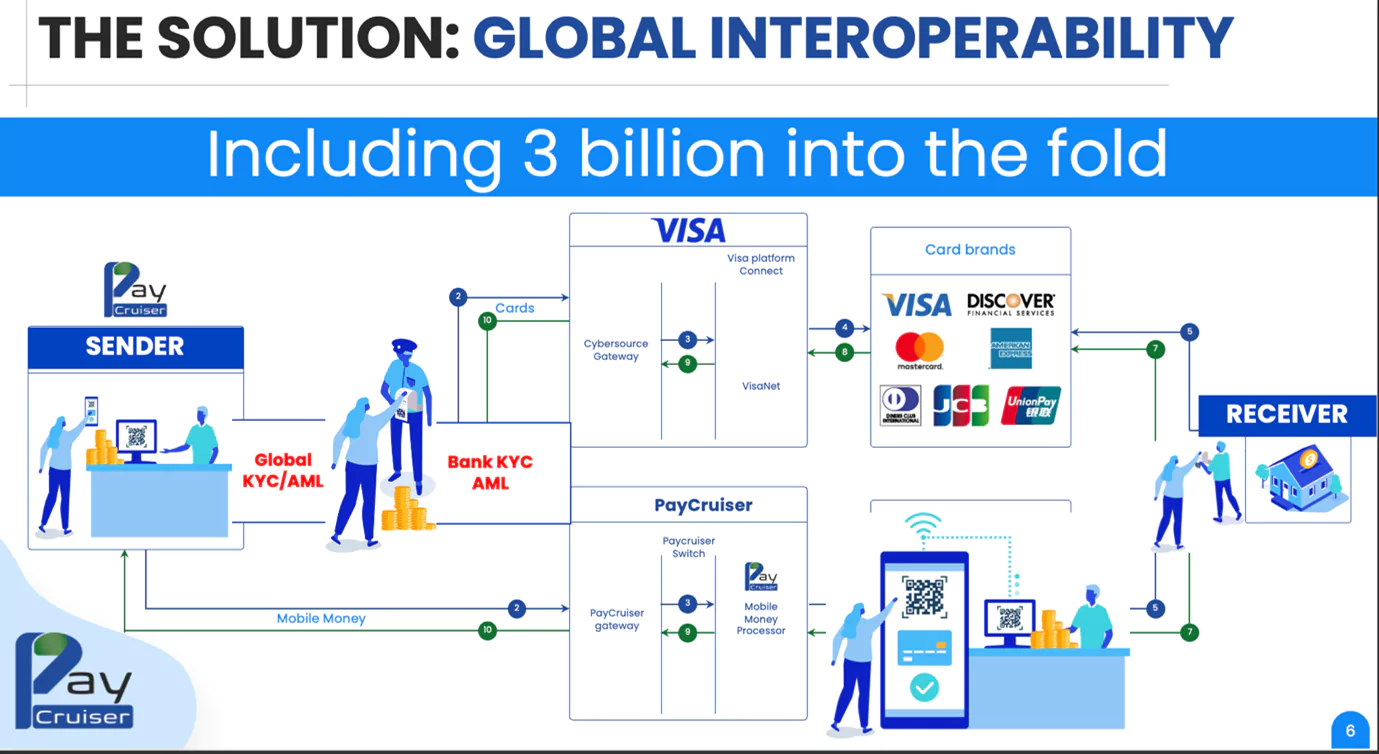

Being the world’s first global, interoperable neobanking platform for the unbanked, PlayCruiser connects financial systems that were never designed to communicate with one another. Imagine sending money seamlessly from Zelle in the U.S. to M-Pesa in Kenya, Orange Money in Senegal, or Revolut in the UK—all using nothing more than a phone number. It’s as though every road, bridge, and highway between cities, countries, and continents were suddenly interconnected overnight.

And the platform doesn’t stop at money transfer. Thanks to partnerships with VISA and global giants like Microsoft, PayCruiser empowers businesses and the unbanked through innovative offerings like VISA prepaid debit cards and agency banking. A corner store in New York or a bakery in a small village in sub-Saharan Africa can now operate as an ATM, bank branch, and more. PayCruiser is bringing financial freedom to communities in hard-to-reach places that were previously left out of the picture.

Yet technology alone isn’t what makes this story stand out. At its core is the humanity that drives PayCruiser’s mission.

Ousmane Conde’s Why: The Mattress That Sparked a Movement

For Ousmane, this isn’t just a business endeavor—it’s deeply personal. Growing up, he witnessed his mother’s struggle firsthand as she hid money in a mattress—the only place she felt it was safe—because the system didn’t serve her. The nearest bank was hours away, and retrieving money from the bank involved, at best, a two-hour trip and a four-hour wait in lines—a whole day wasted for a single mother struggling to feed her children. So, yes, the mattress was the safest and most reliable place to save her hard-earned money.

But this isn’t just Ousmane’s mom’s story. To this day, millions of households worldwide share similar experiences. Over three billion men and women—the unbanked—are financially excluded, unable to fully participate in economies that many of us take for granted. Farmers, merchants, and gig workers in fragile markets rely on outdated systems, perpetuating inequality and inefficiency.

Ousmane knew something had to change. With more than 12 certifications, master’s degrees in AI, computer science, and information security, 15+ years of technical leadership at Fortune 100 corporations like Boeing, and a fierce determination shaped by his past, he set out to create not just a product but a movement—a neobanking platform designed to bridge the divide between the connected and the disconnected, one transaction at a time.

When Ousmane Conde watched his mother stash hard-earned money under a mattress because the financial system had failed her, he didn’t just see a problem—he saw a mission. Today, PayCruiser is the culmination of that mission: a burning desire to prove that financial exclusion is not an inevitability—it’s a solvable challenge.

“My mother taught me resilience,” Conde says. “She didn’t fail me—the system did. PayCruiser is my way of rewriting that story, for her and for the billions that deserve better.” Conde emphasizes.

Creating Heroes In Every Neighborhood

Perhaps the beauty of PayCruiser lies in its simplicity and its power to transform ordinary people into extraordinary agents of change. Take Rosa, for example—a single mom in Miami who runs a modest corner store. By becoming a PayCruiser Agency Banker, Rosa’s store now serves as a community banking hub. Her neighbors can deposit funds into their bank accounts, withdraw cash, pay utility bills, and send digital payments—all in a matter of seconds.

With every transaction Rosa facilitates, she earns a commission. This has allowed her to increase her income while empowering those around her. Rosa is no longer just a business owner—she’s a neighborhood hero.

Now, multiply her story by millions. Across the world, agency bankers like Rosa, farmers in remote villages, and single parents hustling in big cities are rewriting their futures through PayCruiser.

“Just like Uber created the technology to turn everyday cars into taxis, PayCruiser proprietary neobanking technology transforms any store—any phone—into a gateway to financial freedom.” Conde emphasizes.

Tech With a Heart: Why PayCruiser Is Different

There are countless fintech apps, but there’s only one PayCruiser. What sets it apart? Three things: interoperability, AI innovation, and impact at scale.

- Interoperability:

Unlike fragmented services like Venmo and Apple Pay (which operate in silos), PayCruiser is a universal connector. Whether it’s a remittance from Canada to Kenya or payments between villagers in Guatemala, PayCruiser unites disconnected systems into one harmonious network. - AI That Empowers:

PayCruiser’s AI makes financial literacy accessible to everyone. Imagine an app that serves as your personal financial coach, guiding you on saving, spending, and investing—fully tailored to your goals, language, and lifestyle. It can even prepare tax filings for you, transforming finances from confusing to empowering. - Global Reach, Local Heart:

PayCruiser is built for scalability without leaving anyone behind. Its services are tailored to local needs without compromising global ambition. Whether working offline in remote villages or seamlessly integrating with modern systems in metropolises, PayCruiser works everywhere, for everyone.

An Opportunity for Investors: Be Part of the Revolution

Imagine the sheer scale of impact—three billion people connected to the global economy for the first time. Each individual represents untapped potential, each shop becomes a mini bank, and each transaction sparks opportunity—a $200 trillion untapped market.

The future PayCruiser envisions is bold, and eager investors have the chance to make history—not just profits. With five years of innovation, partnerships with VISA and Microsoft, a robust user base of over 1.6 million, over 5000 agency banks and patent-pending technology, PayCruiser is poised for explosive growth.

This is an opportunity to help build the financial bridges of tomorrow while thriving in an industry projected to unlock $200 trillion in economic potential.

“We don’t just want believers; we want co-dreamers. Together, we can build a world where life is defined by one’s own dreams, talents, and aspirations.”

PayCruiser: Because every transaction is a step towards a better world.

Get ready to be inspired by Ousmane Conde, the visionary behind PayCruiser. He will share how this groundbreaking platform is changing financial inclusion around the world.

What is PayCruiser?

PayCruiser is a revolutionary financial neobanking infrastructure. As the world’s first Global interoperable neobanking technology, allowing businesses and individuals to pay and get paid globally with the simplicity of using a phone number as payment method. The recipient receives funds within seconds and can swiftly move them to any VISA debit card, bank account or mobile money wallet. And if the other party does not have access to bank accounts or debit cards, PayCruiser can even create one for them on the spot—hence, connecting them to the global financial ecosystem at scale.

PayCruiser Global Interoperable Neobanking Platform

PayCruiser is perfect for:

- Gig-economy workers

- Legal immigrants

- Families

- Community banking

PayCruiser offers innovative features that empower:

- Safe and seamless deposits and withdrawals

- Instant global money transfers that connect lives

- A unified platform for physical and digital payments

What is Platform Interoperability and why does it matter?

Imagine this: A U.S.-based businessman sits across the table from a supplier in Tokyo. The deal could transform both of their futures. But there’s one major hurdle—they don’t speak each other’s language. Without a translator, the deal falls apart.

Now, imagine this same difficulty happening every single day in the financial world—except instead of language, the barrier is financial platforms that don’t communicate. This is where the concept of platform interoperability comes in. Simply put, platform interoperability creates a common “translator” so one payment platform—like Apple Pay—can seamlessly interact with another, like Google Wallet, Zelle, or even M-Pesa half the world away. Interoperability enables disconnected financial ecosystems to communicate effortlessly in the same way a shared language connects people.

But what does the lack of platform interoperability look like in the real world?

Imagine trying to use Apple Pay to send money to someone with an Android device—or Google Pay to transfer funds to someone who only has an iPhone. It doesn’t work. Or imagine using PayPal to send money to someone who doesn’t have—or can’t open—a bank account. Again, it’s impossible. These systems function like isolated islands, creating unnecessary complexity and leaving billions of people behind.

And because of this lack of interoperability, nearly 3 billion people—including my mom growing up—remain unbanked or financially excluded. That’s more than half the planet, unable to access basic financial services to save, invest, or simply transact money. Why? Because of fragmented systems. Platforms don’t talk to each other. Nations, regions, and payment tools operate as silos instead of bridges—and the people who suffer most are those at the margins of the financial world.

The world is becoming a global village. Connections are faster, communication is instantaneous, and opportunities abound—but only if systems work together. For a farmer in Brazil, a street vendor in Paris, or a construction worker in New York, connecting platforms can mean the difference between stagnation and thriving. It’s about creating a world where access to financial tools isn’t determined by where you live, what device you use, or which bank you belong to.

That’s why we built PayCruiser—not just another payment app but the world’s first truly interoperable global financial platform. It’s a groundbreaking solution designed to bridge these gaps. It is the universal translator for money: PayCruiser doesn’t just operate within platforms—it connects them. Just like bridges connect divided cities, PayCruiser links isolated financial systems, ensuring that anyone—whether banked, underbanked, or unbanked—can pay and get paid effortlessly, no matter where they are or which system they use.

With PayCruiser, you don’t need to think about the platform someone else relies on. Whether it’s Apple Pay, Google Pay, M-Pesa, or simple phone number—PayCruiser creates a seamless connection. We’re not building walls or exclusive access points. We’re building bridges: bridges that connect people to opportunities, bridges that unlock potential, and bridges that enable financial freedom for billions.

At PayCruiser, we believe that where you’re born or what app you download should never dictate your access to connection, dignity, or opportunity. And we are proud to be the first company in the world to democratize platform interoperability at scale, enabling disconnected financial systems to communicate seamlessly in real-time, worldwide.

PayCruiser emphasizes a ‘security-first’ approach. Can you elaborate on the specific security measures and technologies you’ve implemented to ensure safe transactions?

PayCruiser’s commitment to security goes beyond traditional measures, incorporating proprietary AI technology alongside our state-of-the-art global Anti-Money Laundering (AML) and Know Your Customer (KYC) systems. These innovations set a new standard in user authentication and fraud prevention, especially in emerging markets. Our technology can identify and authenticate both genuine and potentially malicious users using nothing more than their mobile number.

We maintain the highest standards of security through strategic partnerships with global corporations like VISA and Microsoft. Additionally, our proprietary government ID and phone verification technology enables us to secure the platform and protect our users, even in areas where social security numbers and credit reports do not exist.

Key features of PayCruiser’s proprietary AML and KYC system include:

- Mobile number-based authentication: Leveraging advanced algorithms to verify user identity through their phone number, reducing friction in the onboarding process.

- Real-time KYC/AML engine: A proprietary system that conducts thorough checks instantly, ensuring compliance with global standards.

- Multi-source verification: Connecting to over 200 partner data sources to validate identities and monitor transactions with the efficiency and precision of industry leaders.

- Global compliance: Meeting or exceeding AML compliance requirements across different jurisdictions, crucial for international operations.

- Continuous monitoring: Employing advanced algorithms to detect and flag suspicious activities in real-time, enhancing fraud prevention.

- Zero Trust Architecture: No implicit trust is granted to users or devices, regardless of their location on the network.

- Context-Aware Access Policies: Access to resources is determined by factors such as user identity, device information, location, and time of day.

- Continuous Authentication: Every request is authenticated and authorized, ensuring ongoing security throughout user sessions.

- Threat and Data Protection: Enhanced security measures protect against data exfiltration and malware, extending to enterprise-managed devices.

- Scalable Deployment: PayCruiser’s flexible end-to-end distributed technology platform allows for global scalability while addressing local security requirements.

- Compliance: The system meets or exceeds compliance requirements from global financial institutions.

- Human Oversight: A team of highly qualified, world-class experts not only trains our AI technology to surpass their expertise but also steps in to handle cases where automation is not yet a viable option.

This system not only enhances PayCruiser’s security infrastructure but also aligns with its mission to serve the unbanked population. By simplifying the authentication process while upholding rigorous security standards, PayCruiser makes financial services more accessible to individuals previously excluded from the global financial ecosystem. The integration of proprietary AML and KYC technology into PayCruiser’s existing security framework—which includes multi-layered security and the BeyondCorp paradigm—further solidifies its position as a “Security First” leader in the fintech and banking space.

What are the biggest challenges you face when deploying your solutions in high-risk regions of the world?

One of the toughest challenges we face in high-risk regions is what we call “honest fraud.” This isn’t the type of fraud that automated tools or AI can easily detect or prevent—because it’s often carried out by insiders within financial institutions themselves. It’s an uphill battle.

For instance, in one emerging market, poorly paid bank agents were caught collaborating with external fraudsters posing as NGOs. When your “banker” becomes part of a fraud ring, the problem extends beyond technology—you’re forced to rely on local justice systems, wasting valuable time and resources that could otherwise be spent connecting unbanked communities to more financial opportunities.

At PayCruiser, we refuse to let such risks compromise financial freedom. To stay ahead of these threats, we developed a proprietary biometric and geo-location verification system powered by AI, designed to augment traditional security measures like 3D Secure. Along with a strict zero-tolerance policy, any fraudulent activity on our platform doesn’t just get flagged—it triggers immediate legal action against those responsible.

For every verified PayCruiser user, our advanced security measures enforce strict compliance with rigorous AML (Anti-Money Laundering) and KYC/B (Know Your Customer/Business) standards. This includes advanced monitoring tools for ID verification, mobile phone checks, SIM swap and VoIP detection, OFAC watchlists, and international sanctions. By protecting honest users and merchants, fraudsters are swiftly identified and reported to local authorities for prosecution—ensuring the integrity of our platform and the trust of the communities we serve.

Ultimately, every security measure we design serves a singular purpose: to empower people to bank safely, no matter where they live. While challenges persist in regions where systems are exploited or broken, PayCruiser ensures that wrongdoers face accountability while honest users unlock opportunities.

How does PayCruiser’s platform accommodate unbanked individuals who cannot read or write Western languages? Can you discuss the role of biometric payments in this context?

At PayCruiser, we believe financial inclusion goes beyond technology—it’s about meeting people where they are, regardless of their literacy level, language, or circumstances. Many unbanked individuals face barriers that most financial systems were never designed to address. For instance, 75% of the unbanked population cannot naturally read or write in Western languages, making traditional banking tools and platforms nearly impossible to use. Instead of seeing this as a challenge, we saw it as an opportunity to build something revolutionary: a platform designed specifically with the unbanked in mind.

First, we turned our focus to accessibility. With over 120% mobile penetration in our target regions, nearly everyone—banked or unbanked—has access to a mobile device, essentially a computer in their pocket. That’s why we built a mobile-first neobanking platform, enabling anyone with a phone to pay bills, send and receive funds, make online purchases, and save money anytime and anywhere. But we knew this wasn’t enough—we had to think beyond screens, keyboards, and text.

For individuals who can’t easily navigate Western interfaces, we developed PayCruiser’s Voice AI technology—a groundbreaking feature that allows users to conduct transactions seamlessly using their native language. We’re literally creating a financial system people can speak to, eliminating reliance on written instructions or complex user interfaces requiring knowledge of western languages. Whether you’re a farmer in Senegal or a shopkeeper in India, your voice becomes your tool of empowerment, opening doors to global commerce.

But we didn’t stop at voice. Recognizing that the unbanked also face unique security vulnerabilities, we integrated biometric payments—an extra layer of protection that is secure, simple, and universal. By enabling users to authenticate payments and account access using biometric data, such as fingerprints or facial recognition, we eliminated the need for traditional passwords or PINs that can be forgotten, stolen, or misused. Combined with our geo-location verification technology, this ensures every transaction is effortless and secure, regardless of literacy level or location.

Other platforms weren’t built for the unbanked—we were. To serve this population, you can’t simply tweak existing technology. It requires personal experiences, deep insights from the ground, and a relentless commitment to flexibility, speed, and security. Many of us at PayCruiser have lived these challenges firsthand, so we understand what’s at stake. That’s why our solutions are cost-effective, fast, and deeply personal—designed to uplift and empower those never included in the designs of traditional systems.

With our patent-pending MobilePay technology, the unbanked aren’t just gaining access to financial inclusion—they’re thriving in a new world of independence. No reliance on middlemen. No literacy barriers. No compromise on safety. And that’s what makes PayCruiser so unique.

How does PayCruiser’s proprietary distributed ledger technology support both global scalability and local customization?

We now live in a world where more than 3 billion people carry computers in their pockets. Leveraging our PhonePay technology, PayCruiser users can engage with the global economy in ways never seen before. They can securely send money anywhere, get paid anytime, and manage funds from virtually anywhere across various platforms—including debit cards, mobile numbers, digital wallets, bank accounts, and even cash.

Imagine a super “Zelle-like” app that enables you to send money and receive payments worldwide using just a phone number—even if the recipient doesn’t have a bank account or card. That’s how PayCruiser redefines financial inclusion, connecting everyone on earth to opportunity.

But what truly sets PayCruiser apart is its adaptability—powered by our proprietary distributed ledger. Here’s how it works:

- Scalability: Designed to handle millions of transactions per second, our distributed ledger technology ensures seamless service even in the busiest, most populous regions. By connecting previously disconnected financial systems into a unified, interoperable network, we make money move both efficiently and inclusively within complex global economies.

- Local Customization: While scalable at a global level, PayCruiser’s technology also adapts to deeply localized needs. We integrate regional payment methods—including mobile phone numbers, offline payments, and cash-based systems—empowering users to interact with the financial ecosystem in ways that feel familiar and trusted. For those in areas with poor infrastructure or dangerous commutes to access physical banks, PayCruiser becomes a lifeline.

However, technology alone doesn’t create connections—it’s how you deliver it. That’s why at PayCruiser, we live by the “platinum rule”: We don’t just connect with people the way we want to—we meet them the way they want to be reached. In every country we operate, we leverage boots-on-the-ground partnerships to deliver financial solutions in culturally relevant and trusted ways.

Take Senegal, for example, where we partnered with SNHLM to launch the EasyKer app—a groundbreaking solution that enables over 200,000 Senegalese citizens to pay their mortgages effortlessly from the comfort of their phones. By integrating EasyKer with PayCruiser’s technology, we’ve eliminated the need for hours or days of transit spent carrying cash to make rent payments.

EasyKer is a PayCruiser-powered digital payment application designed exclusively for SNHLM.

SNHLM has deployed this mobile (contactless) payment app to allow users to securely pay mortgages, contributions, and SNHLM bills from the comfort of their homes. EasyKer empowers users to make payments at their own pace, whenever and wherever they want, while choosing the exact amount they wish to pay.

Plus, users can easily make payments through mobile money accounts, bank cards, or cash at over 6,000 proximity agency banks across Senegal.

When users engage with PayCruiser, they aren’t just making transactions—they’re joining a revolutionary shift toward inclusion, independence, and empowerment. With every phone number converted into a global payment gateway, every transaction becomes a step toward creating a brighter, more connected world.

How does PayCruiser differentiate itself from traditional solutions like Western Union or newer fintech platforms like Revolut? What sets PayCruiser apart?

The answer is simple: PayCruiser is the world’s first global interoperable neobanking platform, and our real competition isn’t other platforms—it’s cash. While others fall short of serving the unbanked or working across silos, PayCruiser picks up where they leave off. From interoperability to agency banking, we transform artificial barriers into bridges, disconnected systems into seamless networks, and isolation into opportunity. We represent the future of financial inclusion—by interconnecting disconnected platforms to redefine what’s possible for global commerce. In doing so, we expand the “pie” for everyone, because we believe that when they win, we all win.

Traditional solutions—and even the latest fintech stars—fail to address the real challenges faced by the 3 billion unbanked people worldwide. These platforms focus on those with privileged access to bank accounts, cards, or established financial systems. But what about the unbanked and underbanked who need to send money, get paid or shop online? What about the talented painter in Saly who dreams of connecting to the global economy so he, too, can thrive?

PayCruiser is the first interoperable neobanking platform designed with one bold mission: to connect the unbanked and underbanked to the global economy. We’ve built financial bridges that others cannot—or do not want to—build.

Imagine trying to send money from Apple Pay to Google Wallet—it’s impossible. Or transferring funds from Zelle to PayPal—it doesn’t work. Then, consider the challenges of paying an employee or receiving payment from a vendor who only deals in cash or lives in an unbanked region. PayCruiser connects them all:

- A Phone is All You Need: Using just a mobile phone number, PayCruiser transforms phones into bank accounts, allowing unbanked individuals to pay bills, send and receive money, shop online, and thrive—all without requiring cash, a card, or a traditional bank account.

- Universal Interoperability: PayCruiser bridges fragmented systems, enabling seamless interactions between platforms like Apple Pay, Google Wallet, PayPal, Zelle, and even offline payment networks. Whether a transaction occurs across continents or around the corner, PayCruiser makes money move effortlessly across every platform.

Here’s where PayCruiser truly revolutionizes the financial world: its agency banking feature.

While traditional solutions like Western Union rely on centralized locations for transactions, PayCruiser transforms every store, shop, and business into a fintech hub. Through our agency banking model, businesses create their own microbanking ecosystems, offering advanced financial services—such as virtual cards, interoperable payment solutions, and secure money transfers—to their customers.

By empowering businesses to become fintech hubs, PayCruiser doesn’t just create access—we turn local businesses into global gateways for financial freedom. Whether it’s a corner store in Senegal or a rural merchant in Pakistan, every agency banking hub becomes an economic anchor, helping businesses grow while unlocking financial access for the communities they serve.

Venmo and Zelle work well—if you have a U.S. bank account and only need to transfer money domestically. But they stop at borders and don’t serve the unbanked.

Revolut is sleek—if you have a card, a bank account, and live within its limited coverage. But it falls short for the unbanked or underbanked.

Western Union offers cross-border payment services—but at a cost. Its high fees and reliance on centralized locations don’t meet the needs of the digital-first, globally connected economy PayCruiser is building.

PayCruiser is different:

- Unlike Venmo or Zelle, we serve both the banked and unbanked, enabling seamless transactions across disconnected platforms.

- Unlike Revolut, PayCruiser isn’t constrained by cards or account-based systems. We operate across devices, geographies, and systems—transforming stores into financial hubs and phone numbers into accessible banking tools. Whether users have smartphones or basic touch phones (via USSD banking), PayCruiser connects everyone to opportunity.

- Unlike Western Union, we scale digitally, eliminating excessive fees and empowering businesses to become their own microbanks with our agency banking feature.

At PayCruiser, we believe financial inclusion isn’t optional—it’s a human right. Every transaction we enable, every partnership we forge, and every tool we create is driven by one clear goal: to connect the unconnected. Whether it’s empowering businesses to become fintech hubs, transforming mobile phones into secure bank accounts, or facilitating seamless transactions across platforms, PayCruiser delivers financial tools to everyone—at scale, with speed, and without borders.

With PayCruiser:

- An Uber driver becomes a global economic gateway.

- A farmer in Ghana securely sends money to her supplier, effortlessly crossing platforms.

- A business owner in West Africa manages his finances from a single app, eliminating the risks of carrying cash on dangerous routes.

This is how PayCruiser moves lives, communities, and entire economies forward.

What are some of the most exciting technological innovations or upcoming features you’re working on for PayCruiser?

At PayCruiser, innovation is the heartbeat of everything we do. Our mission to connect the unconnected isn’t just about solving today’s challenges—it’s about building tools that redefine the future of global finance. Among our most groundbreaking advancements is one of our proudest achievements: Card AI, the interoperable AI-powered debit card so intelligent, it’s like having a financial advisor, personal shopper, and accountant—all in one, inside your wallet.

Some of Card AI innovative features include:

- Effortless Connection Across Accounts: Card AI seamlessly connects to any financial account—whether it’s a bank account, mobile money wallet, or even another debit card.

- AI That Adapts to You: Powered by cutting-edge PayCruiser Voice AI, Card AI evolves to meet your specific needs. Whether it’s financial advice, bill reminders, purchase recommendations, or even health-related suggestions, Card AI learns your preferences, goals, and concerns. It communicates with you in your native language, ensuring you always feel understood and empowered, no matter where you live.

- Global Intelligence and Personal Touch: Card AI understands the distinct financial landscapes of every country. Whether you’re shopping locally or internationally, its AI capabilities provide tailored recommendations, enabling seamless spending, tracking, and management wherever you are. Need budgeting advice? Card AI gives insights. Shopping for groceries? It helps find deals aligned with your goals. Searching for affordable health insurance premiums or preparing for taxes? Card AI offers personalized suggestions. It’s like carrying an advisor that supports every aspect of your financial life—always ready, always personalized, and always speaking your language.

What truly sets Card AI apart is its inclusivity. It’s not a debit card reserved for the privileged few with established accounts or credit lines. Card AI is built for everyone, everywhere.

Integrated seamlessly into the PayCruiser Interoperability ecosystem—where mobile numbers already act as bank accounts—Card AI provides highly intelligent financial support without barriers or limits. Whether you’re a farmer in rural Africa managing funds for a harvest, a farmer in France sourcing affordable supplies, or a student in the U.S., Card AI empowers financial literacy, autonomy, and growth.

What advice would you give to entrepreneurs who are looking to create impactful solutions in challenging markets, especially those with limited access to traditional financial systems?

You can’t learn to ride a bike if you’re too afraid to get on it. And once you finally hop on, you will fall—more than once, maybe even a hundred times. But every fall is an opportunity. If you can learn why you fell—and more importantly, if you can get back up every time—you’ve already set yourself apart from the crowd. That resilience, the same kind that African mothers have, that willingness to fail and grow, is what transforms beginners into masters.

Entrepreneurship isn’t a smooth ride—it’s messy, unpredictable, and requires an unshakable belief in your mission. But here’s the good news: every failure is a lesson, and every lesson moves you closer to success. It’s not about getting it right the first time—it’s about adapting, learning, and relentlessly moving forward. That’s the secret to creating solutions that truly make an impact.

Yet as you push through the struggles—and as success starts to come your way—never forget where you came from and how far you’ve come. It’s easy to get lost in moments of recognition, in the temptations of profit or praise. But staying grounded in your journey—remembering the people and challenges that inspired you along the way—is what will keep you focused on your purpose. That grounding will be your guide in difficult moments, and your compass in times of ethical temptation.

For entrepreneurs working in markets with limited access to traditional systems, my advice is this:

- Step out of your comfort zone: Get into the field. Talk to the people you’re serving. Experience their reality firsthand, even if it feels overwhelming. That’s the only way to build solutions that actually matter. For example, at PayCruiser, much of what we’ve built—from turning mobile numbers into bank accounts to voice-based transactions—came from being on the ground, speaking to people, and understanding what would truly make a difference in their lives.

- Get comfortable with failing: Challenging markets don’t play by conventional rules. You’ll face resistance, unexpected barriers, and moments of doubt. But remember, failure isn’t the end—it’s part of the process. Each setback teaches you how to navigate complexity and adapt your vision.

- Focus on human connection: Technology is only as valuable as the problems it solves. No matter how advanced your ideas are, they’ll only make an impact if they center on the people you’re serving. PayCruiser’s success didn’t come from flashy tech—it came from the simplicity of meeting people where they were with tools they could trust. Always build for humanity, not just for profit.And finally, I’ll leave you with one last piece of advice: carry your purpose with you, no matter what. Keep that purpose in your heart, because, somehow, it already knows your why.

So, get on the bike. Fall. Get back up. Keep pedaling and have fun doing it. Before you know it, you won’t just be riding—you’ll be leading the way for a brighter and fruitful future.