Changing the way individuals and organizations access and manage their finances, the financial technology (FinTech) industry has developed at a very fast pace in recent years.

Major part played by state-of-the-art technologies, and diverse consumer choices, fintech has come up as a smart tech complementing traditional financial services, as per the discussed fintech stats.

Fintech allows users to access advanced facilities and features including digital payments, mobile banking, blockchain, and robo-advisors. Making a space for itself fintech is aimed at improving financial accessibility, efficiency, and user experience.

As consumer demand for digital financial solutions continues to rise, fintech companies are at the forefront of revolutionizing the way we interact with money and manage our finances.

Fintech Market Growth and Adoption

The fintech market has experienced tremendous growth in recent years, driven by increasing consumer demand for digital financial services and innovative solutions.

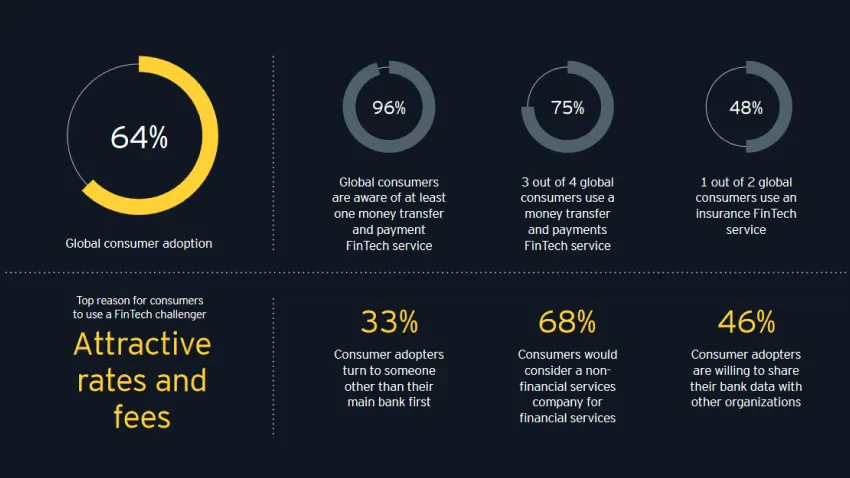

According to research by EY, the global adoption rate of fintech services reached 64% in 2019, up from 16% in 2015.

This surge in adoption highlights the rapid pace at which fintech is disrupting traditional financial services.

One of the key drivers of fintech adoption has been the rise of digital payments and mobile banking solutions.

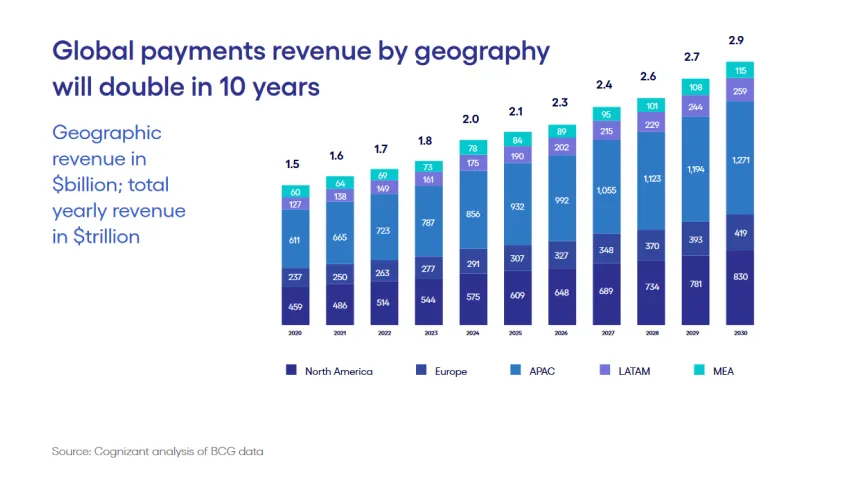

Statista reports that global mobile payment revenue is projected to reach US$3.76tn in 2024 by 2024, up from $1 trillion in 2019.

Transaction value is expected to show an annual growth rate (CAGR 2024-2028) of 12.77% resulting in a projected total amount of US$6.08tn by 2028.

In the Mobile POS Payments market, the number of users is expected to amount to 1.99bn users by 2028.

The average transaction value per user in the Mobile POS Payments market is expected to amount to US$2.26k in 2024.

From a global comparison perspective, it is shown that the highest transaction value is reached in China (US$1,721.00bn in 2024).

This growth is fueled by increasing smartphone penetration, improved security measures, and consumer demand for fast, convenient payment methods.

Regionally, the fintech adoption rates vary significantly. Asia has emerged as a leader in fintech adoption, with markets like China, India, and Singapore at the forefront.

According to EY’s Global Fintech Adoption Index 2019, the average adoption rate in emerging markets stood at 64%, compared to 47% in developed economies.

This trend can be attributed to factors such as large unbanked populations, supportive regulatory environments, and a strong focus on financial inclusion.

In the United Kingdom, fintech adoption has been steadily increasing, with a rate of 42% in 2019, according to EY’s report.

The UK has established itself as a global fintech hub, attracting significant investment and fostering a thriving startup ecosystem.

Initiatives such as Open Banking and regulatory sandboxes have contributed to the growth of the fintech industry in the region.

Key Fintech Stats and Sectors

The fintech industry encompasses a wide range of sectors and applications.

Some of the key areas driving growth and innovation include:

Digital Payments

Digital payments have seen massive adoption in recent years, fueled by the rise of mobile wallets, P2P payment apps, and contactless payments.

In the UK, mobile payment users are projected to reach over 42 million by 2025. The total value of digital wallet transactions globally is expected to exceed $12 trillion in 2026, up from $7.5 trillion in 2022

Mobile Banking

Mobile banking has become the norm, allowing customers to access banking services from their smartphones.

In the UK, over 60% of adults used mobile banking apps in 2021. Worldwide mobile banking users are expected to exceed 2 billion by 2026.

Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies like Bitcoin have captured significant interest and investment.

The global blockchain market size could grow to over $67 billion by 2026, while crypto adoption continues rising steadily.

Regtech and Compliance

Regtech (regulatory technology) solutions help companies comply with regulations more efficiently.

Robo-Advisors

Robo-advisors provide automated, algorithm-driven financial advice and investment management.

Globally, The market is expected to continue growing at an annual growth rate of 8.06% from 2024 to 2027, resulting in a projected total amount of US$2,274.00bn by the end of 2027.

Peer-to-Peer (P2P) Lending

P2P lending platforms match borrowers with individual lenders, disrupting traditional finance. The global P2P lending market could expand at over 30% yearly to reach $558 billion by 2027.

These are just some of the major fintech sectors illustrating the industry’s rapid growth and disruption across financial services.

Fintech Investment and Funding Landscape

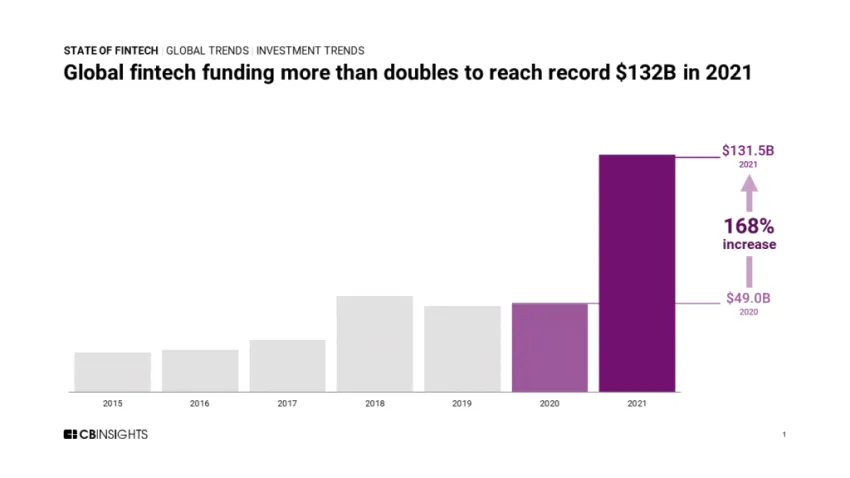

The fintech industry has seen a surge in investment and funding over the past decade as investors recognize the potential for disruption and innovation.

According to data from CBInsights, global fintech investment reached $109.8 billion across 3,491 deals in 2021, more than double the amount invested in 2020.

Venture capital has been a key driver of fintech funding, with VC firms pouring money into startups across digital payments, cryptocurrency, insurtech, regtech, wealthtech, and more.

The UK in particular has established itself as a leading fintech investment hub.

British fintechs attracted $11.6 billion in funding in 2021, second only to the US. London-based companies like Revolut, Wise, and Checkout.com have raised over $1 billion each.

As fintech develops, later-stage funding like IPOs is becoming more common.

However, the turbulent market for tech stocks in 2022 has cooled the IPO pipeline for fintechs.

While the fintech industry has made significant strides in recent years, it also faces several challenges that could potentially hinder its growth and adoption.

Here are some of the key challenges faced by the fintech sector:

- Regulatory Compliance: The financial sector is heavily regulated, and fintech companies must navigate a complex web of regulations and compliance requirements.

- Data Security and Privacy: As fintech companies deal with sensitive financial data, ensuring robust data security and privacy measures is paramount.

- Legacy Systems Integration: Many traditional financial institutions rely on legacy systems and infrastructure, which can make it challenging to integrate new fintech solutions seamlessly.

- Talent Acquisition and Retention: The fintech industry requires a diverse range of skills, including technology, finance, and regulatory expertise.

- Customer Adoption and Trust: While fintech solutions offer convenience and innovation, some consumers may be hesitant to adopt new technologies, particularly when it comes to managing their finances.

Market Growth and Adoption

The fintech (financial technology) industry has been experiencing remarkable growth and adoption rates in recent years.

As traditional financial services increasingly embrace digital transformation, fintech solutions are disrupting and reshaping the landscape.

The global fintech market size was valued at $266.56 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.5% from 2023 to 2030, according to Grand View Research.

This rapid fintech market growth is being fueled by several key factors, and some fintech market statistics, including the increasing adoption of digital payments, mobile banking, and investment apps among consumers and businesses.

A 2022 study by Plaid found that 76% of Americans now use some form of fintech, whether through mobile banking apps, peer-to-peer payment platforms, cryptocurrency exchanges, or robo-advisors.

The fintech industry has emerged as a global powerhouse, with London often dubbed the “fintech capital of the world“.

The fintech sector attracted two-thirds of all fintech funding during 2023 ($73.5 billion)., according to KPMG’s Pulse of Fintech report.

This growth is being driven by a combination of supportive regulations, a thriving startup ecosystem, and strong consumer demand for innovative financial products and services.

Closing Thoughts on the Fintech Market Statistics 2024

The fintech industry has grown and been adopted a lot recently.

As per the latest fintech statistics, the consumer demand for digital finance is growing. As technology advances, we’ve come to expect more innovation and disruption in the industry.

One emerging trend is the rise of embedded finance where financial services are integrated into non-financial platforms and applications.

This could lead to a flood of fintech services and non-traditional players would offer them. These include e-commerce platforms, social media apps, and even car companies.

Open banking initiatives aim to promote data sharing. They want compatibility between financial institutions and third-party providers. They’re expected to drive more innovation in the fintech space.

AI and ML use in fintech is expected to grow, according to a fintech stats forecast by Statista. It’s going to enable more personalized and efficient financial services.

ESG is becoming more important. We may see more fintechs offering products and services that align with sustainable and ethical investing.

This could include the development of green finance solutions and the integration of ESG factors into investment decision-making processes.

The fintech industry faces many challenges. But, its future looks bright. Technology continues to drive innovation and disruption in financial services.

These companies can navigate well. They’ll rank cybersecurity and data privacy. They will embrace emerging trends and technologies. This will position them for success in the years to come.