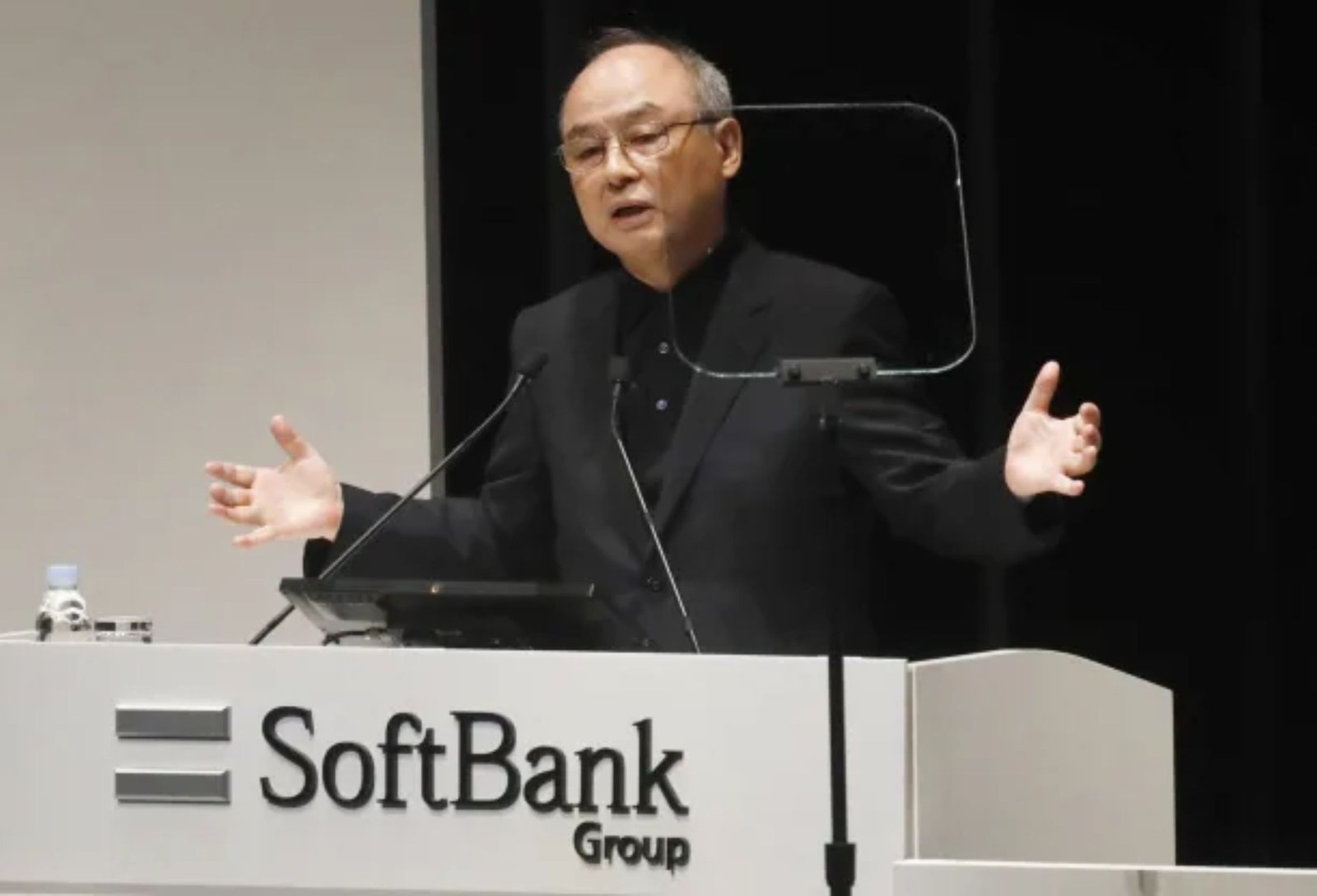

SoftBank Group experienced a significant downturn on Monday, with shares plummeting nearly 19% as global markets faced a widespread sell-off. This sharp decline wiped out billions from the fortune of founder Masayoshi Son, who saw his net worth drop by approximately $4.6 billion, according to Forbes’ real-time billionaire tracker.

The Japanese telecommunications and investment giant, recognized as one of the world’s largest tech investors through its substantial Vision Fund, had been on a rally prior to this decline. The stock’s downward trajectory began last Thursday, coinciding with a dip in Japanese equities following the Bank of Japan’s decision to raise its benchmark interest rate.

The Nikkei 225 index, which serves as a benchmark for the Japanese stock market, recorded a staggering 12.4% loss, marking its worst day since the infamous “Black Monday” of 1987. This sudden drop underscores the heightened volatility in the market as investors react to changing monetary policies.

Prior to the recent downturn, SoftBank’s stock had shown a strong performance this year, reaching record highs, driven in part by the recovery of its Vision Fund division and a substantial increase in the stock price of Arm, the British chip designer largely owned by SoftBank. However, following Monday’s decline, SoftBank’s shares are now only 1.7% higher for the year. CNBC estimates that approximately $28.3 billion has been erased from SoftBank’s market value since the close of trading on Wednesday.

Investors are now looking ahead to SoftBank’s upcoming fiscal first-quarter earnings report, set to be released on Wednesday. Many are hopeful for additional signs of recovery within the Vision Fund, which has been a critical component of the company’s financial performance.

Masayoshi Son, who has remained relatively quiet in recent months, made headlines in June when he resurfaced to share his ambitious vision for the future of artificial intelligence, claiming it could become 10,000 times smarter than humans.

As the market adjusts to recent changes, all eyes will be on SoftBank to see how it navigates the ongoing challenges and what its future holds in the rapidly evolving tech landscape.

Read Also: Visionary Business Leaders to Watch in 2024, Exclusive Insights